Posted on Dec 7, 2024

Why is BharatFD Your Best FD Selection Partner?

We are living in times where investments with potentially high returns are catching the public eye. But amid such high returns comes the inherent risk of capital erosion due to market volatility. For many, market volatility is not welcome! They need to feed their family, meet goals such as child education and require funds to meet contingency requirements. For short-term goals, in particular, aiming for a product that assures safe returns is the right approach. This is where a fixed deposit comes into the equation. It’s a product that ensures returns promised at the time of booking it.

But there also, certain misconceptions lie. These include the increasing belief among people that they can book a fixed deposit with a bank they already have a banking relationship with. Under that impression, they end up compromising on the returns. While some in the lure of higher returns end up booking a fixed deposit with a non-banking finance company or housing finance company with a not-so-good financial condition. People booking a fixed deposit at these institutions can be denied premature withdrawals and get money less than what was promised.

Keeping in mind these, BharatFD is becoming a transformative change by allowing people to enjoy the privileges of higher returns, premature withdrawal facility and greater flexibility with its fixed deposit comparison tool. It’s a tool that allows effective comparison and booking of fixed deposits offered by top banks.

In this blog, we will highlight the role of BharatFD in helping people taste success in their financial lives.

BharatFD - Bringing a Transformative Change in the FD Landscape

High Returns

We at BharatFD have a fixed deposit comparison tool showcasing the interest rates of different banks such as State Bank of India (SBI), HDFC Bank, ICICI Bank, HSBC Bank, IDBI Bank, IDFC First Bank, Bank of India, Barclays Bank, Kotak Mahindra Bank, IndusInd Bank and many other reputed banks. So, no branch visit, no paperwork hassle. Just log on to BharatFD, compare rates and choose the one that pays you the maximum interest.

Safety Assured

While high returns always grab one’s eye, losing sight of safety will not help! We at BharatFD understand the same and thus recommend banks that not only offer high returns but also deliver what they promise. We showcase banks with robust finance, high solvency ratios, fabulous credit ratings, strong management control, etc. These factors combine together to ensure a safe capital base for you.

FD Calculator

Your fixed deposit investments must align with the goal amount. Otherwise, you will feel a bit discontent at the time of maturity. For example, you want INR 5 lakh in five years and want to know the amount you need to book as a fixed deposit. With our FD calculator, you can know the same. Considering the prevailing fixed deposit rates, which can be 7.50% for a 5-year tenure, you need to book INR 3.50 lakh to accumulate INR 5 lakh.

Book FD of Any Bank (No Matter Whether You Have a Banking Relationship with it or Not)

No need to stick with your current banker for a fixed deposit. Assuming you have a savings account with XYZ bank and it offers a fixed deposit for 3 years at a 5.50% return. You open the FD with that bank thinking that a fixed deposit with another bank is not possible. Ditch this myth with BharatFD. You can have a fixed deposit with a bank with whom you don’t have any banking relationship. Trust us, you will find banks with higher returns! This will help you accomplish your financial goals.

Insights into What’s Good and What’s Not for You

We at BharatFD strive to make your fixed deposit journey smoother with sharp selections based on your income and the financial goals you want to achieve. What also matters to your journey is the change in the fixed deposit landscape brought in through RBI regulations, the latest trends, etc. This will further help you make an informed call on fixed deposits.

So, How Can I Book a Fixed Deposit on BharatFD?

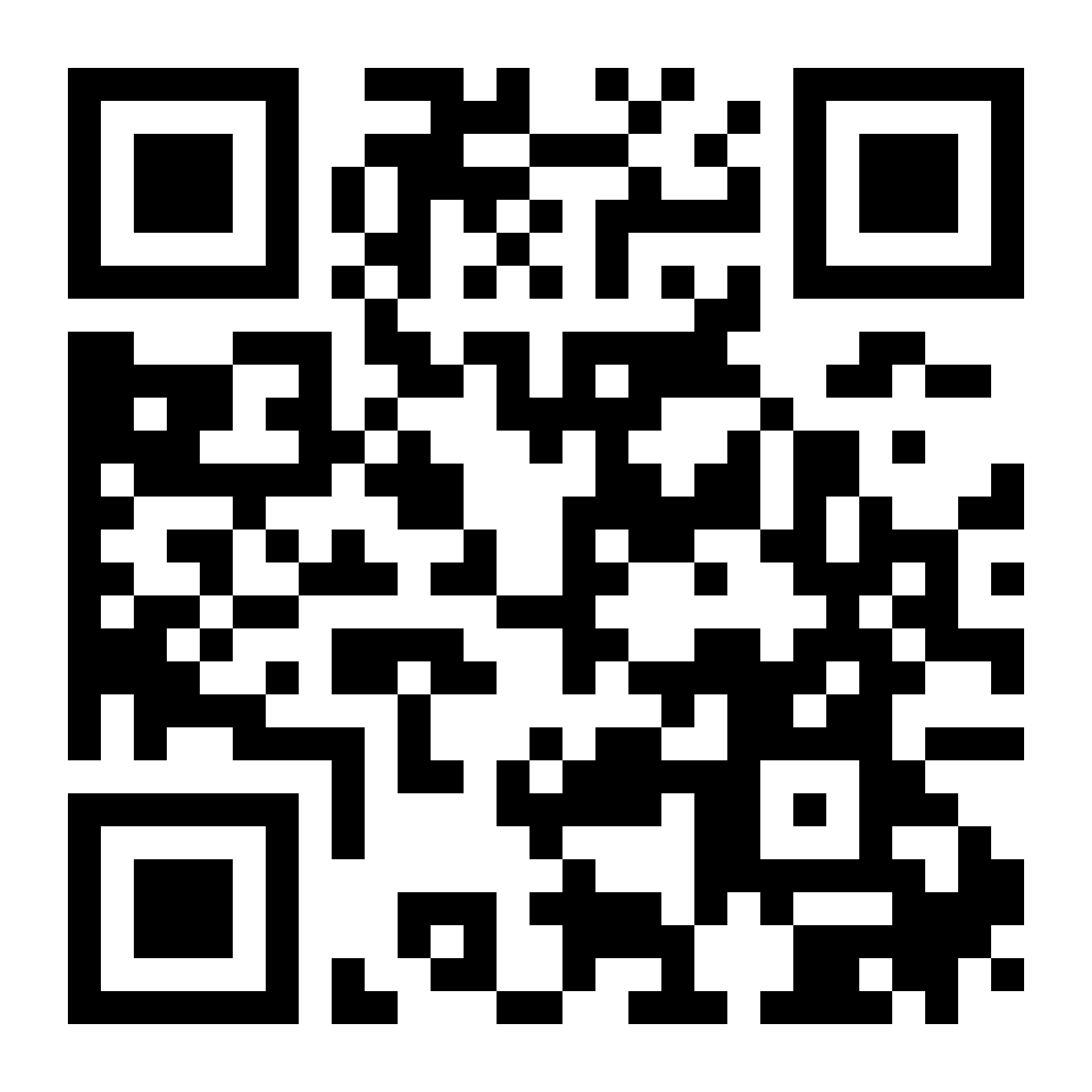

Download the BharatFD app, compare fixed deposit interest rates of different banks, select the bank, and invest after mentioning a few details online. BharatFD keeps your details safe and confidential. Be assured!